Context:

Preference shares is a financial instrument that answers a specific need of companies trying to raise finance but cannot or does not want to do it in the conventional way. The conventional method for a company to raise finance is by issuing equity shares that requires the investor to participate in the risk-reward variances or by resorting to borrowing by providing the lenders the safety cushion of investors’ capital.

The Concept

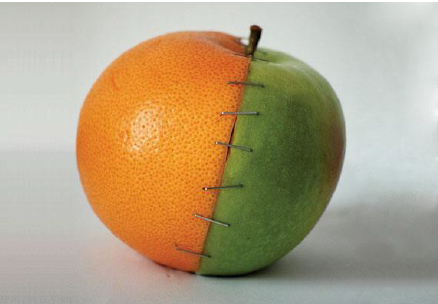

Preference shares is a hybrid instrument that contains both the risk-bearing element of an equity instruments and at the same time enjoy the safety cushion offered for a debt instrument. In the process of fusing these two elements, certain other features available in a pure equity instrument like unrestricted returns or in debt instruments like security is lost, a conscious decision considering the overall benefits obtained which is substantial. Preference shares are treated like equity instruments by the regulators as they are legally a residual liability, i.e. the holders of preference shares are only entitled to a share in the residue left after paying off all the fixed liabilities like borrowings and creditors. At the same time equity shareholders treat preference shares as a debt-like instrument as they have limited participation in decision making and do not share in the gains of the company beyond their contracted return.

The First of First

The challenge in accurately estimating cost of large infrastructure projects is not new and has existed since beginning. Canal construction and railway companies, the first of large infrastructure projects undertaken by commercial financers faced this problem. Companies they floated in the 17th and 18th century in England ran out of funds due to unforeseen engineering complications. Where initial capital raised was often exhausted without completing the project, their promoters faced the challenge of mobilizing additional finance, as new equity investors did not want to be placed on par with the existing equity shareholders as took on higher risk by coming in at a later point of time. The second alternative of raising money though borrowing was legally not permitted as companies of that period could not borrow more than 1/3 of their equity capital.

The need to limit borrowings by companies that enjoyed limited liability was a measure introduced to protect the interest of lenders to companies that was introduced in the 1690s in England.

With the conventional options to raise finance blocked ingenious promoters of canal and railway companies invented preference shares that overcame this limitation. Preference shares appear as capital to the regulators as they are residual liability bearing the risk and reward of the company. But for the investors, preference shares take the nature of debt instruments as they are paid in full prior to the equity investors getting even a rupee back.

Rationale for Preference Shares

- Preference shares are primarily used in capital intensive industries like banks and non-banking finance companies, where legal provisions are in place to limit the extent of debt that these companies can take. In banks these limits are called capital adequacy norms.

- Preference shares are also used where investors are not directly involved in running the business and want the primary decision makers to hold equity shares thereby providing a level of safety net for their investment.

Companies Act, 2013

Section 43 of the Act defines a preference share as shares issued by a company that has the first right to receive either dividend and/or repayment of capital on liquidation before the equity shareholders. The Act also provides for preference shares both with fixed return or preference shares with variable returns colloquially called participating preference shares.

Preference shares are financial instruments used to meet temporary needs of a company and have fixed tenure with a defined redemption date. This is the reason that section 55 of the Act does not permit issue of irredeemable preference shares. Further section 55 also limits the duration of redeemable presence shares issued to less than 20 years.

As redemption of preference shares will result in dilution of security for lenders due to reduction in net-worth, the Act specifically provides for redemption of preference shares only from the proceeds of fresh issue of shares or out of the profits of the company. If the profits of the company are used to redeem the preference shares, an amount equal to the value of shares is required to be transferred to Capital Redemption Reserve, which has the effect of retaining the net-worth without any erosion.

Current Usage

Preference shares can take many forms−redeemable and irredeemable preference shares, convertible and non-convertible preference shares and participating and non-participating preference shares. Irredeemable preference shares is not permitted by law, while all other forms of preference shares can be used today.

Preference shares are today used to meet the debt-equity requirements stipulated by the regulators, also called capital adequacy norm in banking and financial services industry. Further, Compulsorily Convertible Preference shares are today used by angel investors and venture capitalists to bridge valuation differences by linking the conversion value to a future realized financial matrix like revenue multiple, EBIDTA multiple or Profit multiple.